3 Factors Everyone Should Spend More Time Preparing For Retirement

3 Factors Everyone Should Spend More Time Preparing For Retirement

Blog Article

I think that we have all the exact same dream. That dream is to be rich - rich enough without requiring to work to offer all of our requirements, without being a slave to money and without worry of not having enough. Well, aren't we dreaming about retirement? Yes! Retirement is everything about living well without working. You can work if you love it, however you do not have to force yourself.

Start a spending plan. Understanding how much you have coming in and just how much you require to enable for as your living costs is an important action to controlling your finances. This will help you to keep within your income and to not overspend. You can prevent entering unrestrained debt.

Step # 1: Decide what you want retirement to be like. Close your eyes and picture where you desire to remain in retirement. What kind of home will you reside in? What kind of automobile will you drive? Do you see yourself around lots of good friends? Will you do substantial taking a trip or perhaps prefer to stay at home and watch movies with your spouse? Will you be active in sports or in your neighborhood (church, clubs, and so on)?

Why is this? They merely await their after profession retirement planning for too long. They did not start planning early enough, or perhaps they did not have particular enough objectives.

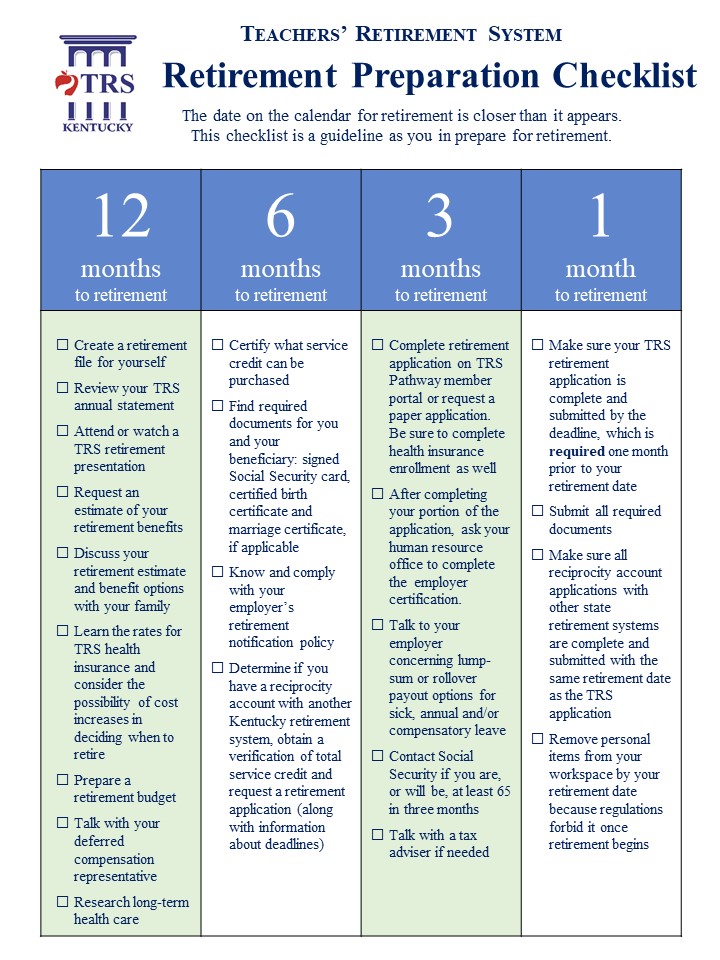

This retirement preparation tool is a simple list. It makes you believe about all the things you need to think about as you begin down your path to a, hopefully, rewarding and effective retirement. Initially the majority of people will not find this easy. Be cautioned there will be many temptations and hazards along the way.

An essential thing to bear in mind is to estimate one's costs after retirement. If one has a rough quote of one's expenses, day-to-day and major spending, then it ends up being easier to conserve much better. If you have an idea of just how much you may spend, then it will not be monetarily burdensome for you at that time, as you currently would have cost savings to pull you through. It would be strongly recommended to have a good medical insurance policy. Retirement age retirement plan brings health problems and you will require additional money to bear such expenditures in case they turn up. You need to also attempt to take good care of your health to avoid such expenditures.

For e.g. Mr. X and Mr. Y both wish to retire at 55 years of age. Mr. X begins investing when he is 25 years of age. So he has thirty years to construct his retirement corpus. Even if he invests just Rs.5000 p.m. in equity shared fund that gives him 15% return p.a. his money can grow to Rs.2.82 cr at the end of 30th year.

While the current economic situation is dismaying, keep in mind that the market recovery. It is best to help if you can manage it. When the marketplace does rebound, you can quickly bridge the loss of you were born in the last two years. Although it might not appear a good idea, this crisis might be the very best time for everyone under 40 starts to build a large retirement. Now is the finest time to invest. You'll benefit immensely when the marketplace rebounds.

Report this page